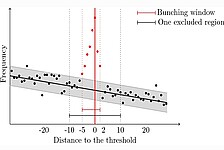

The study deals with the estimation of welfare losses in the context of income taxation that arise due to behavioural changes of individuals. The study exploits the design of the Dutch tax system, which has "kinks" in the tax scale that can be used to identify government welfare losses using the "bunching" approach.

Consistent with the existing literature, the study concludes that individuals reduce their taxable income as the tax rate increases, with the behavioural response being larger for self-employed individuals as well as men. It also shows that a large proportion of individuals use mortgage interest deductions in particular, which can be shifted between jointly taxed individuals, to reduce their taxable income. Welfare losses due to real behavioural adjustments, e.g. through a reduction in working hours, are therefore less likely.